In accordance with the provisions inOpinions Concerning the Talent-driven Development Strategy of Shanghai in the New Era released by CPC Shanghai Municipal Committee and Shanghai Municipal Government, the matters related to online approval (version 3.0) are hereby specified based on the measures introduced during the pandemic, in order to further improve the business environment in Shanghai, the quality of service windows for foreigners working in China, and online approval for Foreigner's Work Permit, and to facilitate the handling of Foreigner's Work Permit by employers and foreign talents.

1. Reinforce matters related to online approval during the pandemic

Application procedure specified in Article 1 of the Notice on the Implementation of Online Approval Process for Matters related to Foreigner’s Work Permit in Shanghai released during the pandemic shall be normalized and reinforced. Specifically, the application for the Notification Letter of Foreigner's Work Permit (Categories B/C), the extension of Foreigner’s Work Permit (Categories B/C), and all procedures of cancellation shall be handled online by the Employer based on the commitment system, without submitting any paper documents onsite for verification. For foreign high-end talents(Category A), the application for such matters as the Notification Letter of Foreigner's Work Permit, the extension of Foreigner's Work Permit, the change of Foreigner's Work Permit shall follow the original process, without submitting any paper documents onsite for verification.

2. Simplify online approval process and shorten the approval period by two working days

Regarding the matters related to online approval specified in the above paragraph (item 1), the original approval period shall be shortened by two working days without handling by the Employer at the windows onsite.

3. Extend the valid period of work permit for Foreign High-end Talents (Category A) to a maximum of five years

To raise the expectation of foreign talents working in Shanghai, the valid period of work permit for Foreign High-end Talents (Category A)shall be extended to a maximum of five years based on the period of their contract and that of other related documents. For those through commitment that the average salary of the year will be6 times or more of the local social average salary the previous year, the valid period of their first work permit shall not exceed one year. Their extension shall be granted when their tax payment certificates are verified and approved. Otherwise, they may supplement relevant documents for handling at a lower level, or their work permits may be cancelled, and this will be included into the credit management system.

4. Extend the valid period of work permit for foreign professionals (Category B)

Foreign Professionals (Category B) may be granted a Foreigner's Work Permit with a maximum valid period of two years based on their contract period and their employer's license. For those through commitment to four times of salary, the valid period of their first work permit shall not exceed one year. Their application for extension shall be granted when their tax payment certificates are verified and approved. Otherwise, their work permits may be cancelled, and this will be included into the credit management system.

If they have already twice handled their Foreigner's Work Permit(one application and one extension) without changing their employers, when they again apply for extension, i.e., the third time, the valid period of their Foreigner's Work Permit may be extended to two years based on the contract period.

5. Simplify application documents for change of employers in Shanghai

In case of change of employers by foreigners who work legally in Shanghai, when their occupation remains the same and they are still in China (within 1 month if their work-type residence permit is cancelled), the new employers shall not need to submit a certificate of no criminal record, certificate of physical examination, or work qualification certificate when applying for a Foreigner's Work Permit in Shanghai.

6. Facilitate the flow of personnel within the group

In the case of change of employers due to flow of personnel between subsidiaries of a group, when the occupation of the foreigners remains the same and they are still in China (when their work-type residence permit remains valid, or within 1 month after their work-type residence permit is cancelled), the new employers shall not need to submit a certificate of no criminal record, certificate of physical examination, academic certificates, or work qualification certificate when applying for a Foreigner's Work Permit in Shanghai. When the group issues relevant certificates, they may choose online approval, without submitting any paper documents onsite for verification.

Recently, the global COVID-19 epidemic situation has changed rapidly, following the notice on airline boarding requirements for Certificates of Negative Nucleic Acid and IgM Anti-Body Blood Tests Results, many countries announced the suspension of entry into China by Non-Chinese Nationals in the overseas holding valid Chinese visas or Residence Permits since last week.

At present, the countries that have announced the suspension include:

UK

France

Italy

Russia

With the spread of the second wave of the global epidemic, the entry policy was further tightened, the number of countries affected by the suspension of entry is likely to expand further.

For countries that have not suspended entry into China at present, they have also begun to implement the requirement of "double negative certificate" of boarding with the Nucleic Acid test and IgM Anti-Body Blood test.

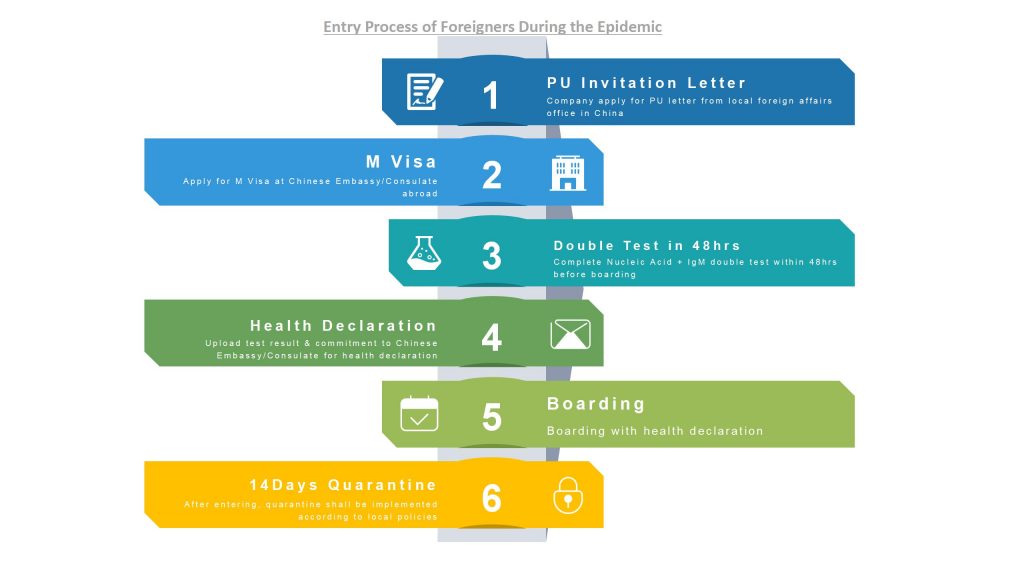

Starting from November, passengers will go through the following new steps:

1. Direct Flight to China

- Complete nucleic acid and IgM anti-body tests within 48 hours before boarding

- After obtaining the both negative certificates, apply for a certified health declaration form Chinese embassies or consulates

- After the Chinese embassy or consulate has passed the application, it shall send the scanned copy of the certified health declaration to the applicant by e-mail. The applicant must print and carry it

- The airline will release the passengers with the health declaration issued by the Chinese Embassy or Consulate. Please take the flight within the validity period of the health declaration

- After entering China, quarantine shall be implemented according to local policies

2. Transfer Through a Third Country

- Take nucleic acid and IgM anti-body tests within 48 hours before boarding at the place of departure

- Apply for a certified health declaration form the Chinese Embassies or Consulates at the place of departure

- Take both tests a second time in the transit country within 48 hours before boarding the plane to China

- Apply for a certified health declaration form the Chinese Embassies or Consulates at the place of transit

- After entering China, quarantine shall be implemented according to local policies

Depending on the newest "double negative certificate" policy, J & K kindly remind here:

- Pay attention to the timeliness of the test report, which is shorten from 72 hours to 48 hours before boarding.

- Consider the following risks of transit:

- Re-do the double tests in transit country

- The airport detection points in most countries and regions do not have the conditions of double tests

- It takes a long time for testing labs to issue certificates, cannot guarantee that transfer passengers will get testing results on time

- Most countries no longer accept applications for health declarations for passengers transiting to China via a third country

- Restrictions on visa application in transit countries

- No entry policy announced by transit countries due to epidemic situation

- Transit countries implement 7-14 day quarantine policy

- Transit hotels impose occupancy restrictions on passengers from high-risk areas

J & K will continue following the immigration policies, please pay close attention to our News Center.

For other policies about entry-exit of China, feel free to contact with us.

Overview

Hong Kong became a Special Administrative Region of the People's Republic of China since July 1, 1997. SAR Basic Law guarantees Hong Kong's capitalist economic system unchanged for 50 years after the handover. Hong Kong will continue to enjoy a high degree of autonomy except defense and foreign affairs. The official languages are English and Chinese.

Although the population of Hong Kong is just over six million, finance and banking services sector remained relatively strong in the international trade. Hong Kong is the world’s ninth-largest trading economy and the third largest financial center. More than 3,200 multinational corporations set up regional headquarters or offices in Hong Kong. Hong Kong is also a gateway into China.

Legal and Tax

Hong Kong company law is based on English common law. Hong Kong is a low tax jurisdiction. Profits, salaries and property tax rates are in the 16% -17.5%, and there also has the various types of stamp duty, equity tax. In addition, there is no capital gains tax, dividend tax or withholding tax.

Only the profits which generated in Hong Kong need to pay tax. The profits which generated outside Hong Kong are not subject to tax. The corporate income tax rate is 17.5%. In addition to the amount of tax exemption, individuals must pay income tax, the income tax rate is incremented by the amount, and the highest rate is 16%.

Rent from the land and buildings in Hong Kong have to pay property tax. In the stock transfer of the company in Hong Kong, the transferor and the transferee must pay stamp duty, the tax rate of 0.1% of the stock exchange price or fair market, subject to the higher of the two prices. The transfer of land and buildings in the territory must prevail in accordance with the higher price of the transaction price or the fair market value as the payment of stamp duty, a maximum rate of 3.75%.

Within the Group owns 90% of the ordinary shares of the parent company and its subsidiaries in the transfer transactions are not required to pay any stamp duty. Hong Kong company must pay 0.1% of the par value equity tax payable tax increase the registered share capital or issue new shares at a premium, a ceiling of 30,000 Hong Kong dollars for each case.

The Company Processing Time

New established company: about 15 working days;

Buying a shelf company: 7 working days.

For more details, please contact J & K.

<< backOverview

British Virgin Islands (BRITISH VIRGIN ISLANDS-BVI) is located between the Atlantic Ocean and Caribbean Sea, with an area of 153 square kilometers. It located in the northern end of the Leeward Islands, 100 km away from the east coast of Puerto Rico, and near the Virgin islands. The British Virgin Islands is one of the members of the Commonwealth, and the official language is English.

British Virgin Islands rely mainly on tourism and financial services. In 1984, the Government promulgated the International Business Companies Act. This legislation has proved to be immensely popular in the international context, the BVI currently become one of the world's most famous offshore financial center. In the past nearly 20 years, more than 400,000 offshore companies registered in there. BVI is one of the financial centers in the Caribbean.

Legal and Tax

The legal system follows the British common law system (but contains some of the provisions of the laws of the State of Delaware of United States in the International Business Companies Act). Companies Act milestone in the development of the International Business Companies Act, enacted in 1984, and a company registered under the Act are entitled to duty-free concessions. Tax Exemptions include capital gains tax, stamp duty and any form of tax-free taxable. In the BVI, the foreign exchange is unregulated.

The Company Processing Time

New established company: about 15 working days, containing Chinese name companies plus 2-3 working days;

Buying a shelf company: 2-5 working days.

For more details, please contact J & K.

<< back

“

Please accept this recommendation for Lillian Zhou and the entire staff at J&K Investment Consulting (Shanghai) Co. , Ltd.

My Company The Charles Boggini Company from Coventry Connecticut USA engaged Lillian to assist in the set up of a trading company in Shanghai China also know as a WOFE . From the first meeting with Lillian I felt comfortable that J&K could handle all the details needed to complete the job.

The entire process was handled in a professional manner and the communication was very clear. Lillian and her staff were able to translate and explain clearly the details all the way thru the process. I was so comfortable with the WOFE setup that I continued with Lillian and J & K to mange my accounting and company details for the past two full year.

The staff is very efficient and detail oriented. I would be happy to refer them to any prospective client.

David C. Boggini

Founder & CEO, Boggini Trading (Shanghai) Co., Ltd

“

We have been cooperating with J & K in the past 6 years and we highly appreciated their visa services for our foreign employees. The number of our foreign employees is big and they work for our Shanghai head office and branches in different cities in China, to

control the employment and visa risk is not quite easy. Fortunately,we found J & K , they are our trustworthy visa consultant, their professional acknowledges and working schedule make us have no doubts and troubles when we are facing the employment and visa issues, no matter application, modification, extension and termination. We highly appreciated their efforts and hope to continue to cooperate and recommend J & K to you.

Vicky Zhou

C&B Manager, ASC Fine Wines

“

We have cooperated with J&K for many years, we deeply felt the professional services of them. When dealing with more complicated work, they always give quick feedback and provide effective solutions. J&K staff are very patient, meticulous and trustworthy. -- Lily Fang, Legal Department of WeWorkJ&K has participated in many company registration and change projects of us. For many years, they have been holding a professional and meticulous working attitude and provided us with extremely satisfactory services. J&K not only excellently completed various project tasks, but also provided us with solutions through their senior experience and knowledge to solve our problems and become an indispensable right-hand assistant in our work. Over the years, J&K and Wework have experienced growth and development together, they help their customers stay invincible in the changeable market competition. I believe that in the future, J&K will be able to serve more and better customers with unlimited future. -- Nancy Hong, Treasury Analyst of WeWork

“

What I admire most about the J & K team is their attitude towards service details. Each of them is striving for perfection. The J & K team has professional background and many years of experience, providing us with extremely satisfactory and pleasant service. Communication is the most important problem in the service, Every time J & K confirms and explains all problems in the work carefully and patiently, even the smallest details they try to ensure that there is no error. J & K not only provides us with high-quality services, but also provides many effective and feasible suggestions and guidance. J & K won the praise of our company, each of us is very willing to recommend such an excellent team to every potential customer.

Jane Hu

Centre Manager, ARCC Spaces

Leave us a message

Interested to Know More?

Please complete the form beside and we will get in touch with you soon!

Content with an asterisk (*) is required.